Economic Architecture of the Inflectiv Protocol

Inflectiv is designed around a fundamental constraint that most data platforms ignore: intelligence is not static, and its value cannot be priced upfront. It emerges over time through usage, feedback, and integration into downstream systems.

The purpose of $INAI is to provide a coherent economic substrate for this process. Rather than treating data as a one-time asset or a fixed-price commodity, Inflectiv models intelligence as a continuously evaluated resource whose value is revealed through interaction.

$INAI is the mechanism that captures, settles, and compounds that value across the lifecycle of datasets, agents, and applications.

From Data Markets to Intelligence Economies

Most data marketplaces operate under a transactional model: a dataset is listed, priced, and sold. This model assumes that value is known at the time of listing. In practice, this assumption fails almost immediately.

The real value of a dataset only becomes apparent after it is queried repeatedly, integrated into workflows, and relied upon by agents or applications. Early users bear uncertainty, later users benefit from accumulated trust and refinement, yet traditional pricing models treat all access equally.

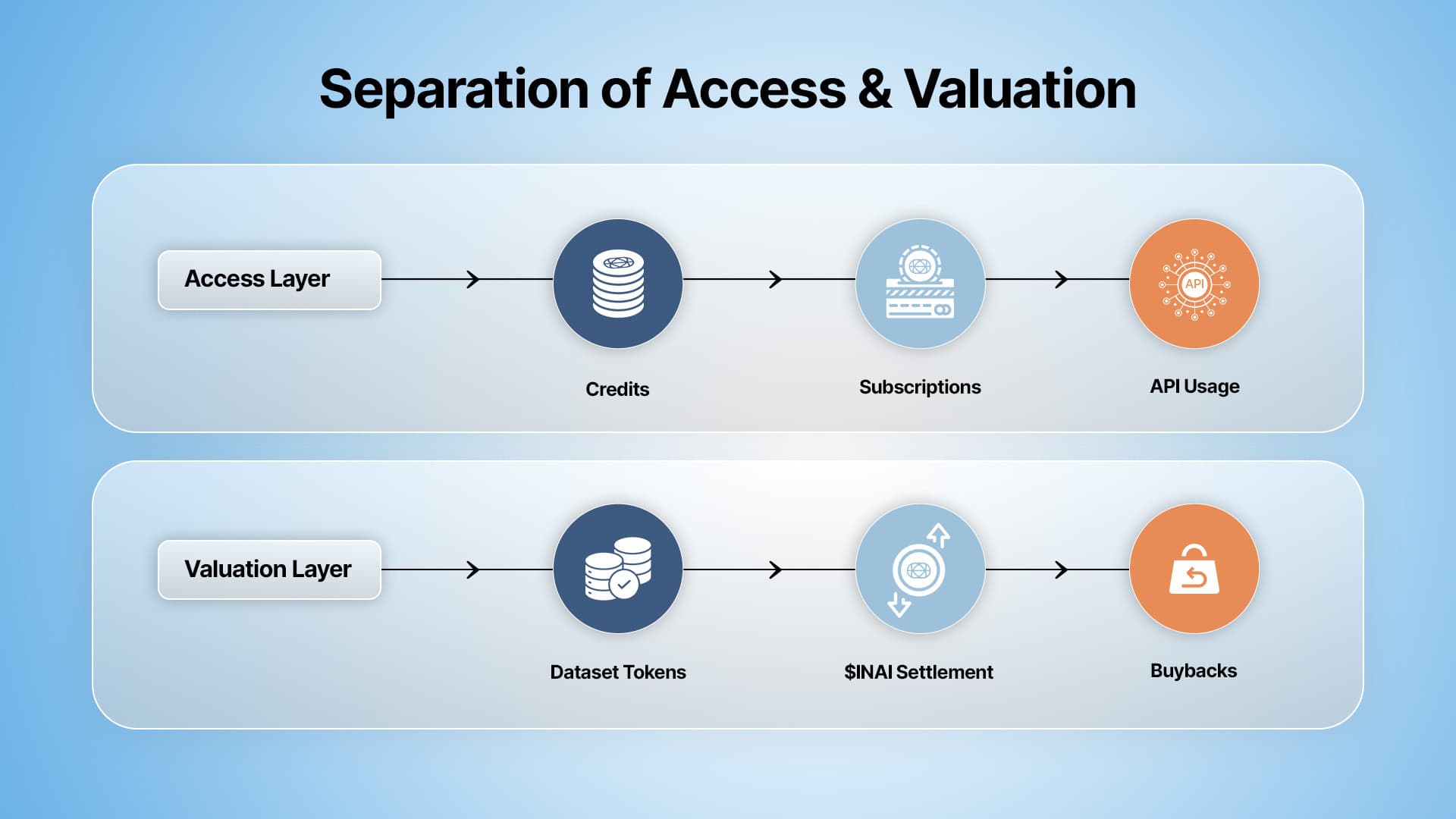

Inflectiv departs from this model by separating access from valuation.

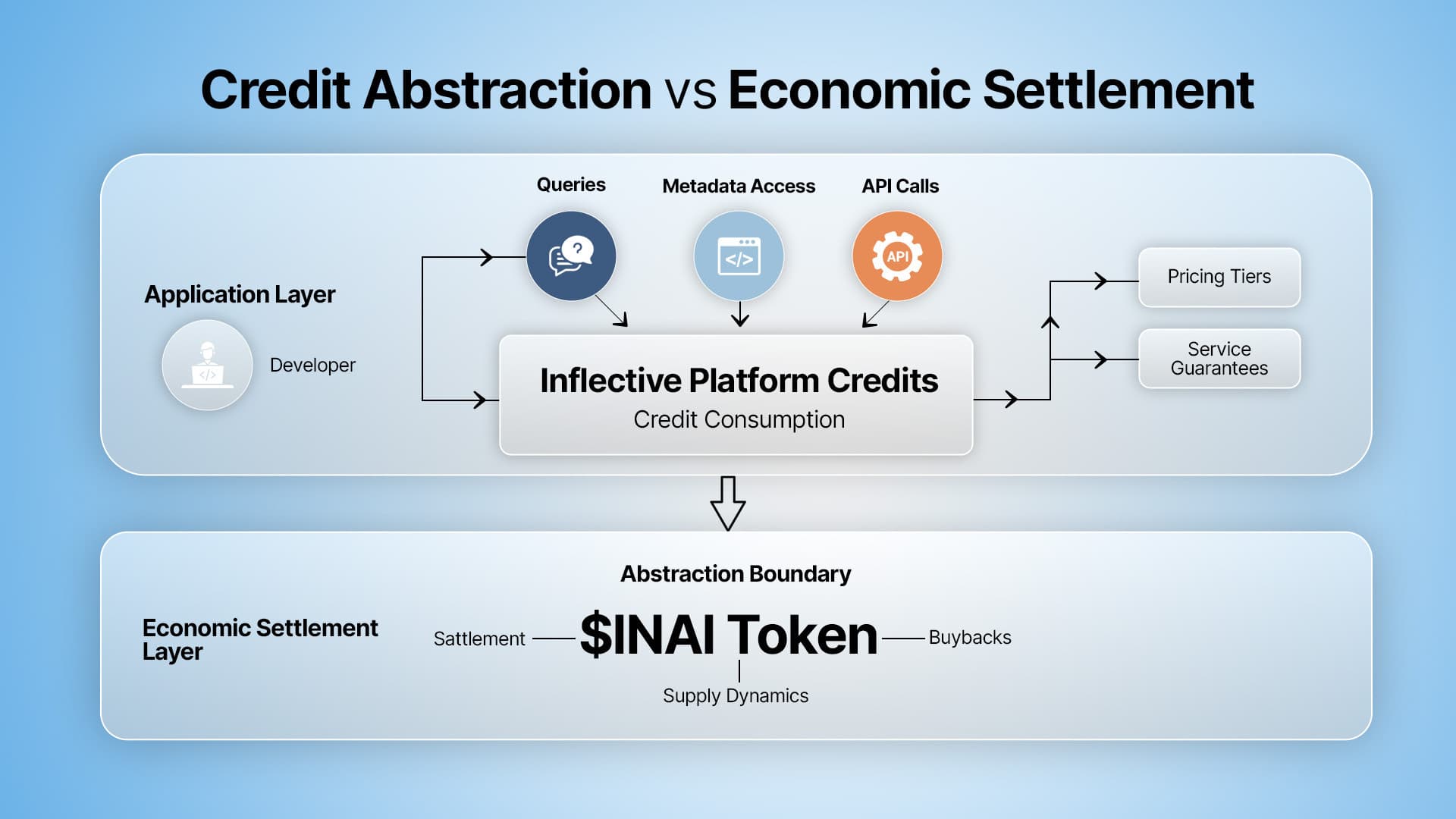

Access is handled operationally through credits and subscriptions. Valuation is handled economically through tokenized signals and usage-weighted feedback loops. $INAI sits at the intersection of these layers.

$INAI as the Settlement Layer

$INAI is not designed to be a consumer-facing utility token. Its role is infrastructural.

Every economically meaningful action inside Inflectiv eventually resolves into a settlement event denominated in $INAI. This includes dataset token creation, bonding curve participation, liquidity provisioning, and buybacks triggered by usage.

By centralizing settlement at this layer, Inflectiv avoids fragmentation of incentives and ensures that all value flows remain observable, auditable, and bounded by a fixed supply.

This design choice is deliberate. Systems that allow value to escape into parallel reward tokens, per-dataset credits, or isolated incentive pools lose coherence over time. $INAI enforces a single accounting unit across the protocol.

Dataset Tokenization as a Market Signal

Tokenizing a dataset in Inflectiv does not confer access rights. It does not gate APIs, unlock features, or substitute for credits. This distinction is critical.

A dataset token represents a market hypothesis about the long-term usefulness of a dataset. It allows participants to express belief, skepticism, or conviction through price discovery, without interfering with operational usage.

This avoids a common failure mode in tokenized systems, where access and speculation are conflated, leading to either paywalls that restrict adoption or tokens that lose relevance once access is abstracted away.

In Inflectiv, access is orthogonal to ownership.

Dataset Token Creation and Creator Alignment

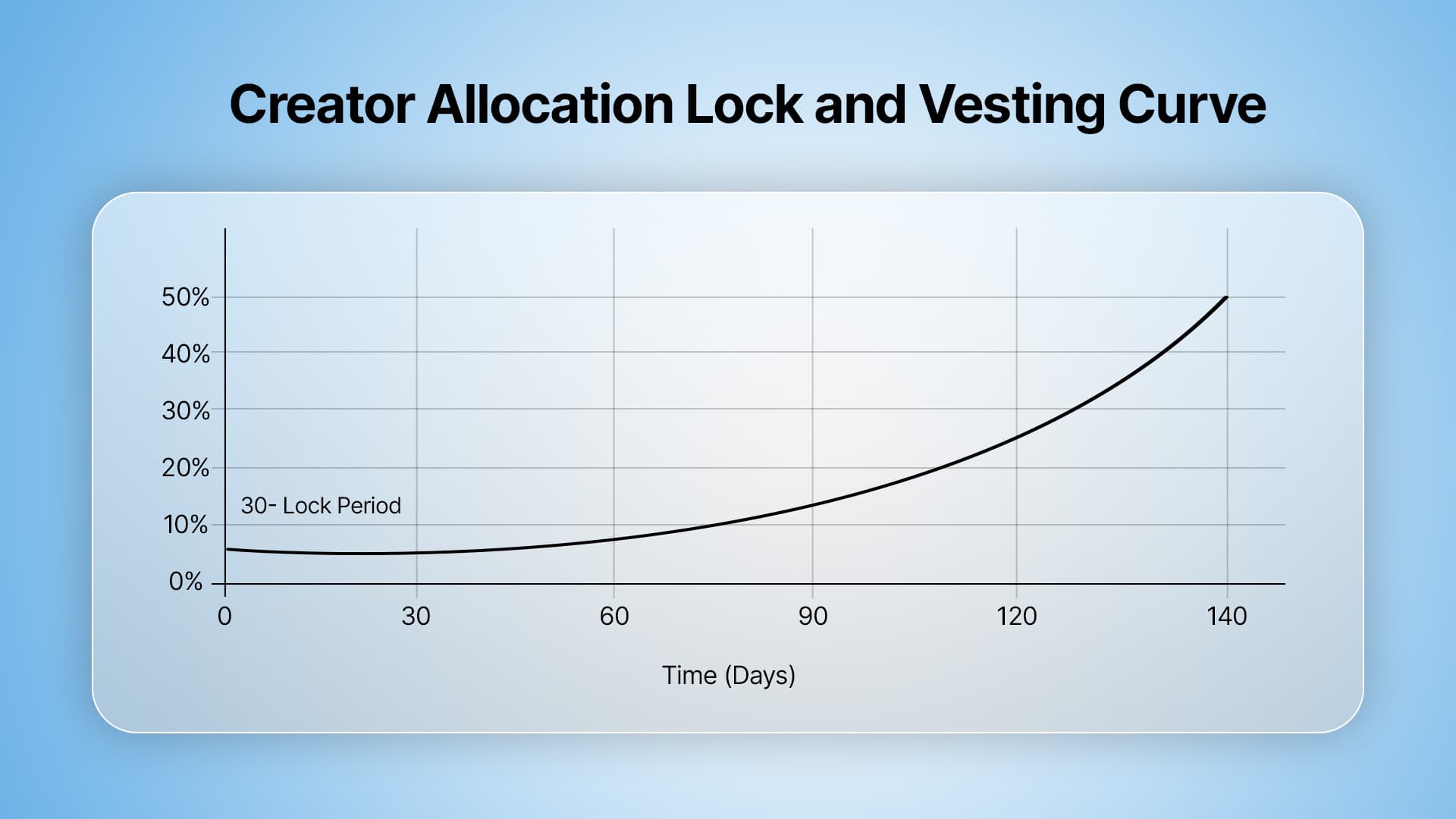

When a creator chooses to tokenize a dataset, they initiate a controlled issuance process.

The creator defines the token's identity and retains a portion of supply, capped at 49 percent. This retention is not immediately liquid. A mandatory lock period of 30 days is enforced, followed by a linear daily unlock proportional to the retained allocation.

The purpose of this structure is twofold. First, it eliminates immediate exit incentives at launch, ensuring that creators cannot extract value before the dataset demonstrates real adoption. Second, it aligns creators with downstream usage, since the value of retained tokens depends on long-term demand rather than short-term speculation.

Token creation requires payment in $INAI, anchoring the dataset token to the broader protocol economy from inception.

Bonding Curves as Controlled Price Discovery

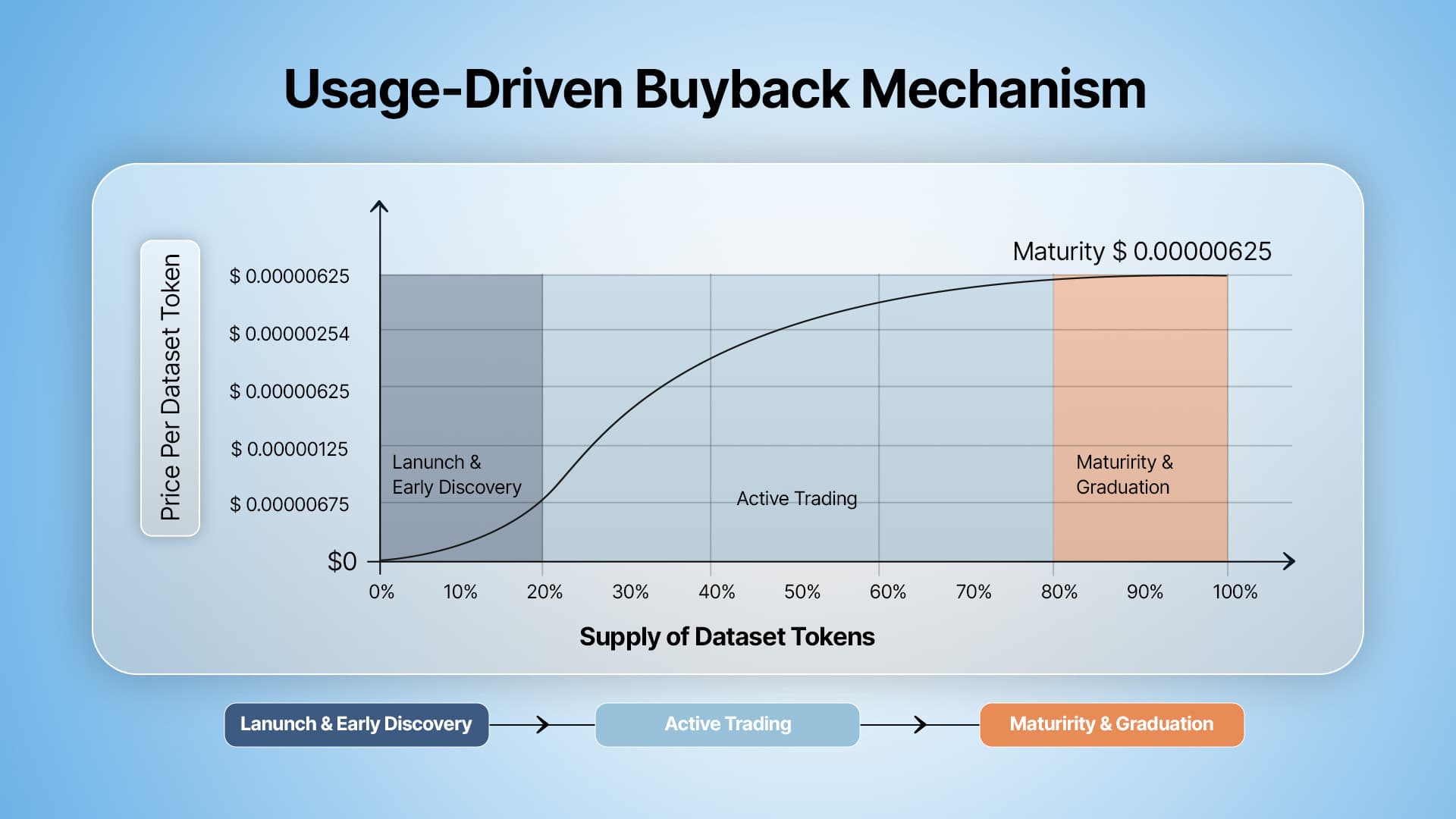

Following creation, dataset tokens enter a bonding curve phase denominated in $INAI.

Bonding curves are used not as speculative accelerants, but as controlled price discovery mechanisms. They allow early participants to collectively determine an initial valuation without requiring the protocol or the creator to provide upfront liquidity.

Inflectiv employs virtual reserves to initialize these curves. This ensures that no real capital is required at launch, while still allowing meaningful price movement based on demand.

Participants interact with the curve using $INAI, and the price adjusts algorithmically as tokens are bought or sold.

The curve remains active until it reaches a predefined maturity threshold, expressed as a USD-equivalent amount raised in $INAI. At present, this threshold is set at approximately $3,000, though it is explicitly designed to be adjustable as market conditions evolve.

This maturity threshold is not intended to filter for “successful” datasets. Rather, it acts as a minimum signal that sufficient interest exists to justify open-market trading.

Graduation and Liquidity Formation

Once the bonding curve reaches maturity, the dataset token graduates.

At this point, the bonding curve is closed and liquidity is created on a decentralized exchange. Liquidity tokens are time-locked, preventing immediate withdrawal and ensuring market stability.

Graduation marks a transition, not an endpoint. The dataset token now exists in an open market, but its long-term value is no longer driven by speculative inflows. Instead, it becomes increasingly coupled to actual dataset usage.

Usage as the Primary Value Driver

The core economic insight of Inflectiv is that intelligence should be appreciated through use.

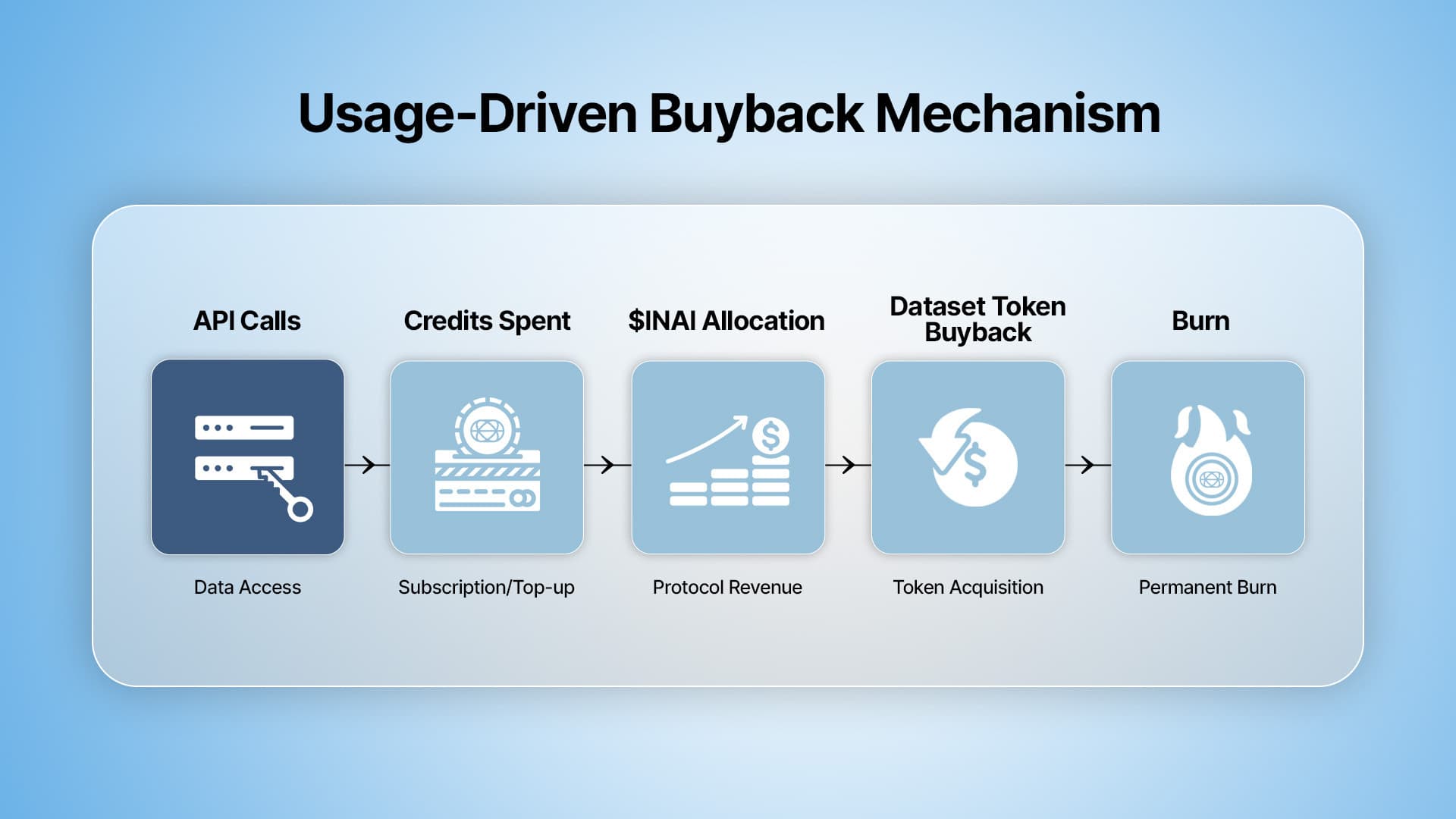

Developers interact with datasets via APIs and SDKs, consuming credits in proportion to their usage. These credits are purchased through subscriptions or direct top-ups and represent real revenue flowing into the system.

Inflectiv monitors this usage at the dataset level. When cumulative usage crosses defined thresholds, a portion of protocol revenue is allocated to buybacks of the corresponding dataset token.

These buybacks are executed using $INAI and the purchased tokens are permanently burned. This creates a direct, mechanical link between real-world usage and supply reduction.

Anti-Manipulation Design

A critical property of this system is that not all usage is equal.

Only paid SDK usage counts toward buyback triggers. Free queries, internal testing, or self-referential calls do not contribute. This prevents creators or attackers from artificially inflating usage metrics to extract value.

Furthermore, dataset creators do not receive per-query royalties. Their upside comes from two sources only: upfront access fees if they choose to charge for access, and appreciation of retained tokens driven by genuine demand.

This removes incentives for low-quality datasets optimized for volume rather than utility.

Credits as the Operational Interface

From a developer perspective, Inflectiv behaves like a conventional SaaS platform.

Queries, metadata access, and API calls consume credits. Credit pricing varies by plan tier, reflecting infrastructure costs and service guarantees. Developers do not need to understand or manage $INAI to build on the platform.

This abstraction is intentional. By separating economic settlement from the application layer, Inflectiv can operate as shared data and intelligence infrastructure for AI systems at scale.

$INAI operates beneath this abstraction, handling settlement, buybacks, and supply dynamics without leaking complexity upward.

Supply Discipline and Distribution

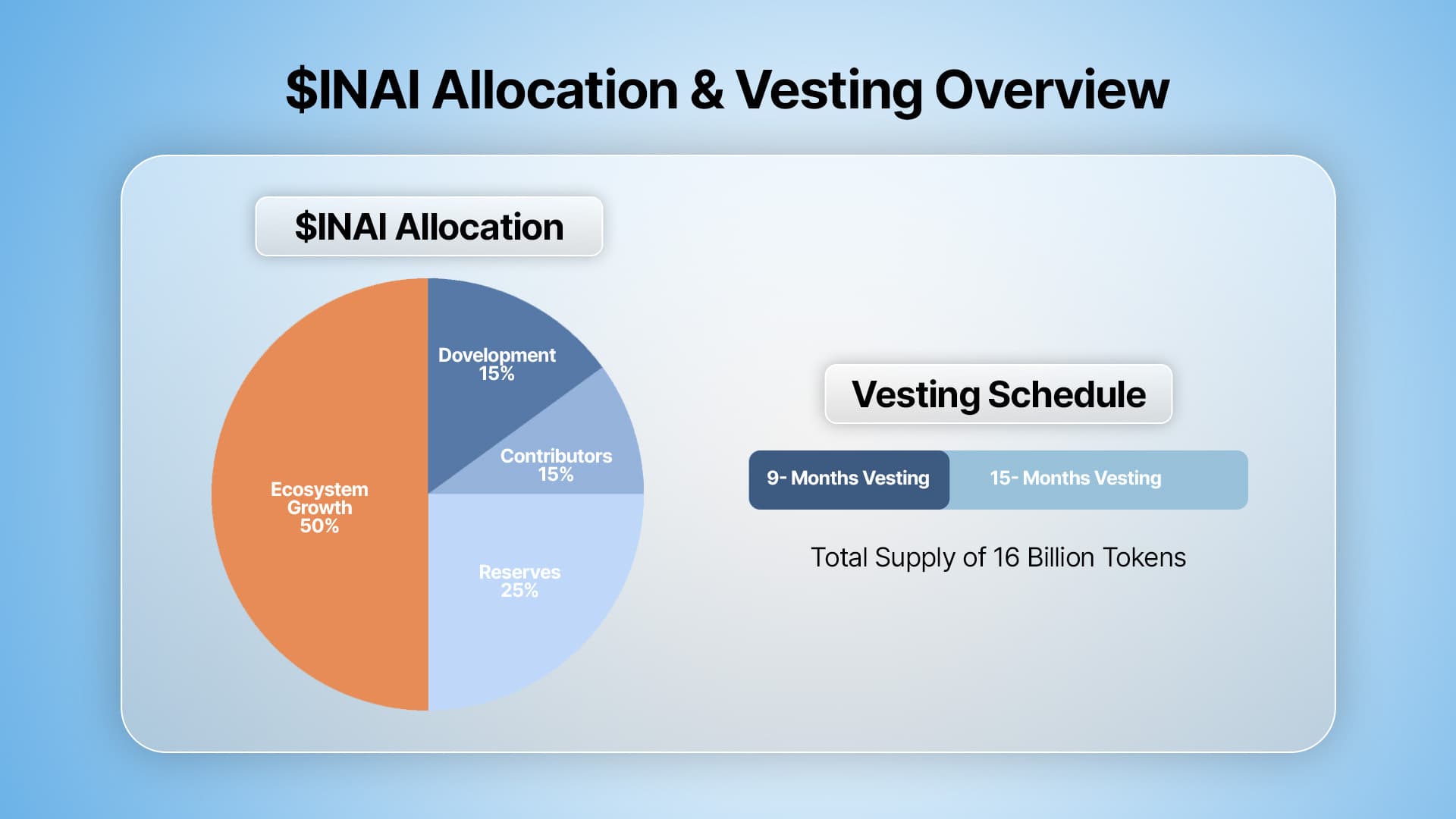

$INAI has a fixed total supply of 16 billion tokens.

There are no reflexive emissions tied to activity, usage, or participation. Growth consumes supply rather than expanding it.

Allocations are distributed across ecosystem growth, reserves, development, and contributors, with vesting schedules designed to prevent short-term extraction and align long-term incentives.

A 9-month cliff followed by 15 months of vesting ensures that meaningful supply enters circulation only as the protocol matures.

Cross-Chain Consistency

$INAI is deployed with a single canonical supply.

Tokens are minted on a source chain and bridged to destination chains using standardized lock-and-mint mechanisms. Bridging does not create additional supply, nor does it fragment liquidity semantics.

This allows Inflectiv to operate across multiple ecosystems while preserving a unified economic model.

System-Level Implications

Taken together, these mechanisms produce a system with several emergent properties.

First Value accrues to datasets that are actually used, not those that are marketed most aggressively. Second, creators are incentivized to improve quality over time rather than optimize for launch-day hype. Third, speculative activity is bounded by real demand, since supply reduction only occurs through usage.

Finally, $INAI functions as a ledger of collective belief and utility across the entire protocol.

It does not promise returns. It records outcomes.

Inflectiv does not attempt to price intelligence in advance. It allows the market to discover that price gradually, through interaction, usage, and reliance.

$INAI is the economic memory of that process.

It ensures that as intelligence becomes more useful, it also becomes more scarce.

This is how we build the intelligence economy.